Worried about unexpected hiccups ruining your dream vacation? Citibank cardholders might have a valuable, often overlooked, benefit: travel insurance coverage. Understanding what's included in this coverage and how to access it can provide significant peace of mind on your next trip. Let's explore the ins and outs of Citibank travel insurance for cardholders, providing clarity on its protections and how you can leverage it for a worry-free travel experience, ensuring you're prepared for the unexpected. This article dives deep into the specifics of Citibank Travel Insurance Coverage for Cardholders, covering its benefits, how to use it, and what to watch out for.

All About Citibank Travel Insurance Coverage for Cardholders

Citibank travel insurance coverage for cardholders is essentially a package of benefits designed to protect you financially when things go wrong during a trip. It's not just about medical emergencies; it can also cover things like trip cancellations, lost luggage, and travel delays. Think of it as a safety net woven into the fabric of your Citibank credit card. The specific coverage can vary greatly depending on the type of Citibank card you hold, making itcrucialto understand the details associated with your specific card.

The evolution of travel insurance within credit card benefits has been interesting. Initially, it was often a limited, supplementary benefit. Over time, competition among card issuers has driven improvements, with more comprehensive coverage and higher payout limits becoming more common. This has made it an increasingly valuable perk for frequent travelers. The importance of this coverage is undeniable. Unforeseen circumstances can arise, and having this insurance can save you from potentially significant financial burdens, ensuring your trip remains enjoyable despite challenges. Expert opinions generally agree that understanding and utilizing these benefits is a smart financial move for cardholders.

What makes Citibank’s travel insurance stand out? One key differentiator is the range of covered incidents. Some cards offer protection against a broader spectrum of scenarios, including things like emergency medical evacuation or repatriation of remains, which can be incredibly expensive without insurance. The ease of filing a claim is another important factor. Citibank typically provides a straightforward process for submitting claims, often online, which simplifies the experience during a potentially stressful time. However, it's important to compare your Citibank card benefits with standalone travel insurance policies. Some standalone policies may offer more extensive coverage for niche situations or higher coverage limits, and thus may be worth it for some people.

Benefits of Citibank Travel Insurance Coverage for Users

The advantages of Citibank travel insurance coverage are numerous for the everyday traveler. It directly enhances your user experience by adding a layer of security and confidence to your travel plans. Imagine your flight is unexpectedly canceled. With the right Citibank card, you could be reimbursed for non-refundable expenses, allowing you to rebook your trip without incurring significant additional costs. This can be a lifesaver, especially during peak travel seasons when last-minute flight prices soar.

Consider another real-life scenario: you arrive at your destination, only to find your luggage is missing. Citibank travel insurance can help cover the cost of essential items while you wait for your bags to be located, saving you from having to dip into your vacation budget to replace clothing and toiletries. These kinds of protections are invaluable, turning potentially stressful situations into manageable inconveniences.

Compared to purchasing separate travel insurance policies, utilizing the built-in benefits of your Citibank card can be more cost-effective, especially for frequent travelers. While standalone policies offer tailored coverage, Citibank’s travel insurance is often included as a perk, meaning you don't have to pay an additional premium for basic protection. However, it's important to weigh the benefits of each. If your trip involves high-risk activities or expensive non-refundable bookings, a more comprehensive standalone policy may still be worth considering. Studies have shown that travelers with travel insurance are more likely to report a positive overall travel experience, highlighting the peace of mind it provides.

How to Use Citibank Travel Insurance Coverage for Cardholders

Understanding how to use Citibank travel insurance coverage is just as crucial as knowing it exists. Here’s a breakdown of the steps involved:

1. Review Your Card's Benefits Guide

The first and most important step is to carefully review the benefits guide that came with your Citibank card. This document outlines the specific coverage you're entitled to, including the types of incidents covered, the coverage limits, and any exclusions. Pay close attention to the terms and conditions, as these define the scope of the insurance.Understanding these terms is criticalto ensure you are actually covered for the specific circumstances of your trip.

Best practices involve downloading a digital copy of the benefits guide to your phone or tablet for easy access while traveling. You should also note down the claim filing phone number or website provided in the guide. Common mistakes to avoid include assuming all Citibank cards have the same coverage (they don't!) and neglecting to read the fine print regarding exclusions.

2. Make Purchases with Your Eligible Citibank Card

In many cases, for the insurance coverage to be valid, you need to make your travel purchases, such as airline tickets or hotel bookings, with your eligible Citibank card. This requirement is in place to verify your eligibility for the benefits.Using the correct card for your travel expenses is essential.

When booking, keep detailed records of your transactions, including confirmation emails, receipts, and itineraries. This documentation will be crucial when filing a claim. Avoid using other payment methods for major travel expenses, as this could invalidate your coverage.

3. File a Claim Promptly

If an incident occurs during your trip that you believe is covered by your Citibank travel insurance, it's vital to file a claim promptly. The benefits guide will specify the deadline for submitting claims, which can vary depending on the type of incident. Delaying the claim process can result in denial of coverage.

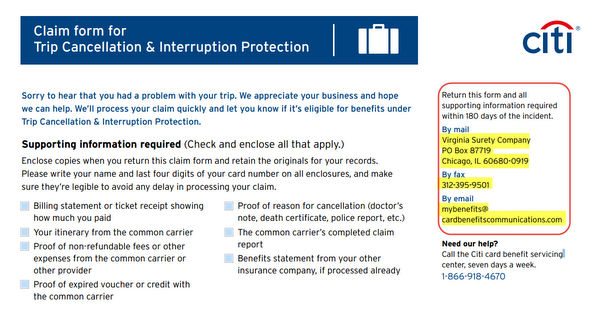

When filing a claim, provide all the required documentation, including proof of purchase, travel itineraries, police reports (if applicable), and any other supporting evidence. Be as detailed and accurate as possible in your claim description. Ensure you understand the specific requirements for the type of claim you are making, as this will help you avoid delays or rejections.

Tips Before Using Citibank Travel Insurance Coverage for Cardholders

Before embarking on your trip, take these preparatory steps to ensure your Citibank travel insurance coverage works effectively: Confirm Eligibility: Double-check that your Citibank card is indeed eligible for travel insurance coverage. Some cards may have been discontinued or may have different benefits packages than others. Call Citibank customer service if you're unsure. Understand Exclusions: Be aware of what your travel insurance doesnotcover. Common exclusions include pre-existing medical conditions, participation in extreme sports, and travel to certain high-risk destinations. Carry Necessary Documents:Keep a copy of your card benefits guide and contact information for the claims administrator readily accessible, both digitally and in hard copy.

Ignoring these tips could lead to unpleasant surprises. For example, assuming you're covered for a pre-existing medical condition when you're not could result in significant out-of-pocket medical expenses if you require treatment while traveling. Failing to understand the claim filing process could lead to delays or denial of coverage. Thorough preparation is key to maximizing the benefits of your Citibank travel insurance.

Common Issues and Solutions Related to Citibank Travel Insurance Coverage

Users occasionally encounter challenges when dealing with Citibank travel insurance coverage. Here are some common issues and practical solutions: Claim Denials:Claims are sometimes denied due to insufficient documentation, failure to meet eligibility requirements, or the incident falling under an exclusion.

Solution: Carefully review the denial letter and address the reason for denial. Gather any missing documentation, clarify any misunderstandings, and, if necessary, appeal the decision. Difficulty Reaching Claims Administrator: Contacting the claims administrator can be difficult, especially during peak travel seasons.

Solution: Persist in your attempts to contact the administrator. Keep a record of your calls or emails, and escalate the issue if necessary. Consider contacting Citibank customer service for assistance. Unclear Coverage Details: Understanding the specifics of your coverage can be confusing due to complex policy language.

Solution: Contact Citibank customer service for clarification. Ask specific questions about your coverage, and request written confirmation of any verbal agreements.

Conclusion

Citibank travel insurance coverage for cardholders offers a valuable layer of protection for your travel plans. By understanding the benefits, following the steps to utilize the coverage, and being aware of common issues and solutions, you can travel with greater peace of mind. It is essential to thoroughly review your card's benefits guide, make purchases with your eligible Citibank card, and file claims promptly and accurately. Don't underestimate the potential savings and convenience this built-in perk offers. Take the time to understand and utilize your Citibank travel insurance coverage to enhance your travel experience and protect yourself from unexpected financial burdens. We encourage you to actively leverage this benefit on your next trip!

Post a Comment for "Citibank Travel Insurance Coverage for Cardholders"