Planning a trip with United? Worried about the unexpected? Navigating travel insurance options can be overwhelming, but understanding United's offerings and policy insights is key to protecting your travel investment. This guide unravels United's travel insurance, exploring benefits, usage, and common issues to help you travel with confidence.

All About Travel Insurance with United Options and Policy Insights

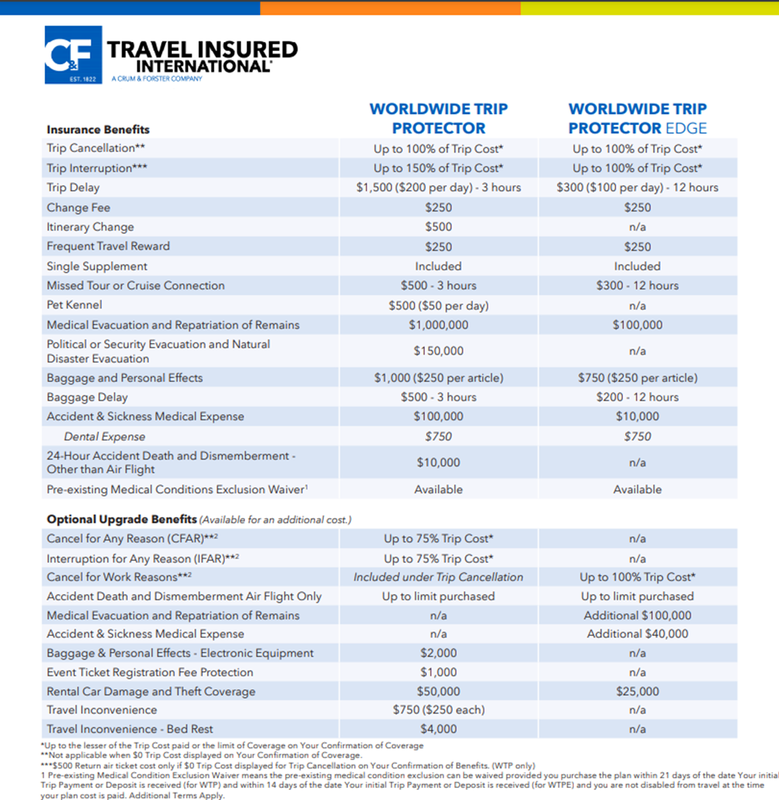

Think of travel insurance as a safety net for your trip. United offers various travel insurance options, often through partnerships with established insurance providers. These policies are designed to protect you from financial losses associated with unforeseen events that can disrupt your travel plans, such astrip cancellations, medical emergencies, lost luggage, andtravel delays. Travel insurance with United provides peace of mind, allowing you to enjoy your journey knowing you're covered if things go wrong. These policies are not one-size-fits-all; they are tailored to different travel needs, offering varying levels of coverage and protection.

Historically, travel insurance was often an afterthought, something people considered optional. However, with increasing global instability and the complexities of modern travel, it's become an essential component of trip planning. Key developments include the rise of comprehensive policies covering a wider range of risks and the integration of technology to simplify claims processing and policy management. The shift towards greater transparency and consumer awareness has also shaped the evolution of travel insurance, with companies striving to provide clear and concise policy information.

What sets United's travel insurance options apart is their integration with the United travel ecosystem. This allows for seamless booking of insurance alongside flights and other travel services. The potential for integration provides easy access to coverage details, claim forms, and customer support through the United platform. Policies typically offer features liketrip cancellation, interruption coverage, medical expense coverage, baggage loss or delay coverage, andemergency assistance.

Experts in the travel industry often highlight the importance of carefully reviewing policy details to understand the scope of coverage and any exclusions that may apply. Testimonials from travelers who have benefited from travel insurance underscore the value of this protection in mitigating financial losses and providing assistance during challenging situations.

Benefits of Travel Insurance with United Options and Policy Insights for Users

United travel insurance enhances the user experience by offering a layer of financial security and support throughout the journey. If you need to cancel your trip due to illness, the policy can reimburse non-refundable expenses, such as flight tickets and hotel reservations. In case of a medical emergency abroad, the insurance can cover medical bills, hospitalization costs, and even emergency evacuation, preventing you from incurring substantial out-of-pocket expenses.

Imagine a scenario where a traveler experiences a sudden illness just days before their departure. Without insurance, they would lose the money spent on flights, accommodation, and tours. However, with a comprehensive travel insurance policy, they can claim a refund for these expenses, minimizing their financial loss. Similarly, if a traveler's luggage is lost or delayed, the insurance can compensate them for the cost of replacing essential items.

Compared to alternative technologies, such as relying solely on credit card travel protections or self-insuring, United's travel insurance offers broader coverage and more comprehensive assistance. Credit card protections typically have limitations and may not cover all potential risks, while self-insuring can be risky, especially when dealing with significant medical expenses or unforeseen travel disruptions.

Data and research consistently show that travelers with insurance report higher satisfaction levels and lower stress levels during their trips. Studies have also demonstrated the significant financial benefits of travel insurance in mitigating losses due to unexpected events.

How to Use Travel Insurance with United Options and Policy Insights

1. Purchasing Your Policy

The first step is selecting and purchasing your travel insurance policy. When booking your United flight, you'll typically be offered the option to add travel insurance during the booking process. Review the policy details carefully, paying attention to the coverage limits, exclusions, and any pre-existing condition clauses.

Best Practice: Compare different policy options to find the one that best meets your individual needs and budget. Look at the coverage limits offered for trip cancellation, medical expenses, and baggage loss. Consider factors like the length of your trip, your destination, and any specific risks you may face.

2. Understanding Your Coverage

After purchasing your policy, take the time to thoroughly understand the terms and conditions. This includes knowing what events are covered, what the coverage limits are, and how to file a claim. Keep a copy of your policy documents with you during your trip, both electronically and in print.

Common Mistakes to Avoid: Failing to read the fine print, assuming that all events are covered, and not knowing how to contact the insurance company in case of an emergency.

3. Filing a Claim

If you experience an event that is covered by your policy, such as a trip cancellation, medical emergency, or lost luggage, you'll need to file a claim with the insurance company. Gather all relevant documentation, including receipts, medical records, and police reports. Follow the instructions provided by the insurance company for submitting your claim.

Ensure Each Step Is Easy to Follow: Most insurance companies have online claim portals that allow you to submit your claim and track its progress. Be sure to provide accurate and complete information to avoid delays in processing your claim.

Tips Before Using Travel Insurance with United Options and Policy Insights

Before embarking on your trip with United and relying on your travel insurance, there are a few preparation guidelines to consider. First, make sure you've truthfully disclosed any pre-existing medical conditions. Failure to do so could invalidate your policy. Second, understand the limitations of your coverage. Some policies exclude certain activities or destinations.

Recommendations on What to Avoid: Don't assume your policy covers everything. Read the fine print. Avoid engaging in risky activities that are specifically excluded from coverage.

Possible Consequences of Ignoring These Tips: If you fail to disclose a pre-existing condition or engage in an excluded activity, your claim could be denied, leaving you responsible for all associated costs.

Common Issues and Solutions Related to Travel Insurance with United Options and Policy Insights

One common issue is claim denials. This often happens due to insufficient documentation, failure to meet the policy's terms and conditions, or the event not being covered by the policy. To avoid this, always provide complete and accurate information when filing a claim and ensure you understand the policy's coverage limits and exclusions.

Another potential problem is delays in claim processing. This can occur due to high claim volumes or the need for additional information. To expedite the process, respond promptly to any requests from the insurance company and provide all necessary documentation as quickly as possible.

Offer Practical Solutions and Troubleshooting Steps: If your claim is denied, you have the right to appeal the decision. Follow the insurance company's appeals process and provide any additional information or documentation that may support your claim.

Conclusion

Travel insurance with United offers a valuable safety net for your travel plans, providing financial protection and peace of mind in case of unexpected events. By understanding the available policy options, knowing how to use the insurance effectively, and being aware of potential issues and solutions, you can travel with confidence and minimize your financial risk.

For optimal use, thoroughly research and compare different policies to find the one that best meets your individual needs. Read the policy documents carefully, understand the coverage limits and exclusions, and keep a copy of your policy with you during your trip. By taking these steps, you can ensure that you're adequately protected and prepared for any unforeseen circumstances that may arise. It is hoped that you can implement travel insurance with United options in your daily life if you decide to travel!

Post a Comment for "Travel Insurance with United Options and Policy Insights"