Planning a trip to the Southern Hemisphere conjures images of breathtaking landscapes, vibrant cultures, and unforgettable adventures. From the sun-drenched beaches of Australia to the majestic peaks of Patagonia, the Southern Hemisphere offers a world of exploration. But before you pack your bags and embark on your journey, there's a crucial aspect to consider: travel insurance. Securing the right coverage can transform a potential disaster into a manageable hiccup, allowing you to focus on creating lasting memories.

Imagine finding yourself in a remote corner of New Zealand, experiencing a sudden illness, or dealing with lost luggage in Argentina. These unexpected events can quickly derail your travel plans and leave you facing significant financial burdens. Navigating unfamiliar healthcare systems, language barriers, and logistical challenges can add to the stress. The peace of mind that comes with knowing you're protected against these possibilities is invaluable.

This article delves into the world of Southern travel insurance review coverage specifically tailored for the Southern Hemisphere. We will examine what to look for in a policy, discuss the unique considerations for this region, and guide you in selecting the best travel insurance plan to safeguard your adventure. By the end, you'll be equipped with the knowledge to make informed decisions and travel with confidence.

Ultimately, understanding Southern Hemisphere travel insurance means knowing your destination's specific risks, selecting a policy with adequate medical coverage, considering trip interruption and cancellation benefits, and evaluating the level of coverage for lost or stolen belongings. We'll explore these factors and more, ensuring you're well-prepared for your Southern Hemisphere adventure. Keywords related to this topic are: travel insurance, Southern Hemisphere, medical coverage, trip cancellation, lost luggage, travel risks, adventure travel.

Personal Experience with Southern Travel Insurance

A few years ago, I embarked on a backpacking trip through South America. I meticulously planned my itinerary, booked accommodations, and researched the best hiking trails. However, I underestimated the importance of comprehensive travel insurance. While exploring the Andes Mountains in Peru, I unfortunately fell ill with altitude sickness and required immediate medical attention. I was fortunate enough to be able to get a medical helicopter to transfer me to the closest Hospital, but the bill came out to a total of $20,000 USD. Without proper travel insurance, the cost would have been astronomical. It was a harsh lesson, but it instilled in me the importance of choosing a travel insurance policy that specifically covers high-altitude sickness and includes emergency evacuation services. This experience taught me to diligently read the fine print and ensure that the policy aligned with my travel activities and destinations.

This personal experience underscores the significance of thoroughly researching travel insurance options tailored to your specific needs when traveling in the Southern Hemisphere. The altitude sickness, remote locations, and limited access to quality healthcare in some regions can pose significant risks. Ensuring your policy covers these eventualities can provide invaluable peace of mind. Furthermore, consider policies that offer 24/7 customer support in English or your preferred language, as this can be particularly helpful in stressful situations. Remember to compare quotes from different providers, read customer reviews, and assess the policy's overall value before making a decision. Taking these precautions can help you protect yourself from unforeseen financial burdens and ensure a safer, more enjoyable travel experience.

What is Southern Travel Insurance Review Coverage?

Southern Travel Insurance Review Coverage encompasses the evaluation and analysis of various travel insurance policies specifically designed for trips to the Southern Hemisphere. This type of review examines the policy's features, benefits, limitations, and overall suitability for the unique travel risks associated with destinations like Australia, New Zealand, South America, and parts of Africa. It involves scrutinizing the policy's medical coverage, trip interruption and cancellation benefits, lost or stolen belongings protection, and emergency assistance services. The review also assesses the insurer's reputation, customer service, and claims processing efficiency.

The goal of Southern Travel Insurance Review Coverage is to provide travelers with comprehensive information and unbiased recommendations to help them choose the most appropriate travel insurance plan for their specific needs and travel plans. The review takes into account factors such as the traveler's age, health conditions, planned activities, and the specific destinations they intend to visit. By thoroughly evaluating different policies, Southern Travel Insurance Review Coverage empowers travelers to make informed decisions and safeguard their trips against unforeseen financial losses or medical emergencies. It also helps travelers understand the policy's limitations and exclusions, ensuring they are aware of any potential gaps in coverage. This comprehensive approach to travel insurance evaluation can significantly enhance the traveler's peace of mind and contribute to a safer, more enjoyable travel experience.

History and Myth of Southern Travel Insurance Review Coverage

The concept of Southern Travel Insurance Review Coverage has evolved alongside the increasing popularity of travel to the Southern Hemisphere. Historically, travel insurance was a relatively straightforward product, primarily focused on covering basic medical expenses and lost luggage. However, as adventure tourism and exploration of remote destinations became more common, the need for specialized travel insurance policies tailored to the unique risks of the Southern Hemisphere emerged. This led to the development of more comprehensive policies that cover activities such as hiking, skiing, diving, and wildlife safaris.

One of the myths surrounding Southern Travel Insurance Review Coverage is that all travel insurance policies are the same. In reality, there can be significant differences in coverage, exclusions, and benefits. Some policies may not cover pre-existing medical conditions, while others may have limitations on coverage for certain activities or destinations. It's crucial to carefully read the policy's terms and conditions and compare different options to ensure it meets your specific needs. Another myth is that travel insurance is only necessary for high-risk activities. While it's essential for adventure travelers, travel insurance can also be beneficial for those planning more relaxed trips. Unexpected events such as flight cancellations, medical emergencies, or lost luggage can happen to anyone, and travel insurance can provide financial protection and peace of mind. By dispelling these myths and understanding the history of Southern Travel Insurance Review Coverage, travelers can make more informed decisions and choose the right policy for their Southern Hemisphere adventures.

Hidden Secret of Southern Travel Insurance Review Coverage

A hidden secret of Southern Travel Insurance Review Coverage is understanding the fine print and knowing what'snotcovered. Many travelers assume their policy will cover everything, but policies often have exclusions for pre-existing conditions, certain extreme sports, and specific events like civil unrest or natural disasters. Digging into the details reveals what's truly protected, and where the gaps might lie. Knowing these exclusions is crucial for making informed decisions and potentially seeking additional coverage to fill those gaps.

Another often overlooked aspect is the importance of understanding the claims process. Knowing how to file a claim, what documentation is required, and the timeframe for reimbursement can significantly impact your experience. Some insurers have a more streamlined process than others, and reading customer reviews can provide valuable insights into their claims handling efficiency. Furthermore, it's essential to keep copies of all important documents, such as medical records, receipts, and police reports, as these will be needed to support your claim. By uncovering these hidden secrets and taking proactive steps to understand your policy and the claims process, you can maximize your chances of a smooth and successful experience with Southern Travel Insurance Review Coverage.

Recommendation of Southern Travel Insurance Review Coverage

My recommendation for Southern Travel Insurance Review Coverage is to thoroughly research and compare multiple policies before making a decision. Don't simply choose the cheapest option, as it may not provide adequate coverage for your specific needs. Instead, focus on finding a policy that offers comprehensive medical coverage, trip interruption and cancellation benefits, and protection for lost or stolen belongings. Pay close attention to the policy's exclusions and limitations, and ensure it covers the activities you plan to participate in during your trip. Look for insurers with a solid reputation for customer service and efficient claims processing.

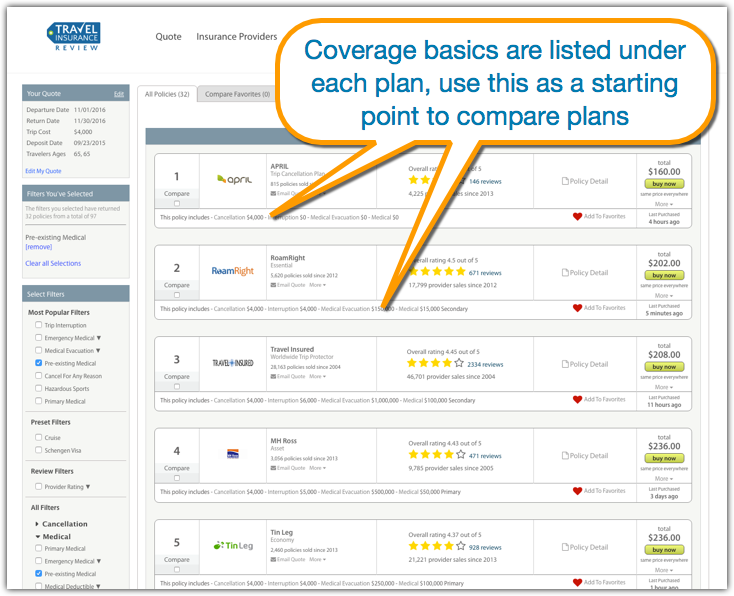

Consider using online comparison tools to quickly compare quotes and features from different providers. Read customer reviews and testimonials to get a sense of their experiences with the insurer. If you have any pre-existing medical conditions, be sure to disclose them to the insurer and ensure they are covered under the policy. If you're planning any high-risk activities, such as hiking, skiing, or diving, look for a policy that specifically covers these activities. Finally, don't hesitate to contact the insurer directly to ask questions and clarify any doubts you may have. By following these recommendations, you can make an informed decision and choose a travel insurance policy that provides the best protection for your Southern Hemisphere adventure.

Detailed Breakdown of Medical Coverage

Medical coverage is arguably the most critical aspect of Southern Travel Insurance Review Coverage. The unpredictable nature of travel, coupled with potential exposure to unfamiliar environments and health risks, makes comprehensive medical coverage essential. This coverage should include provisions for emergency medical expenses, hospitalization, surgery, ambulance services, and prescription medications. It should also cover medical evacuation to the nearest appropriate medical facility, which can be particularly important in remote or underserved areas of the Southern Hemisphere.

When evaluating medical coverage, pay close attention to the policy's limits and exclusions. Some policies may have caps on the amount they will pay for certain types of medical treatment, while others may exclude coverage for pre-existing medical conditions or injuries sustained during certain activities. It's also important to understand how the policy handles deductibles and co-pays. Some policies may require you to pay a certain amount out-of-pocket before coverage kicks in, while others may have a co-pay arrangement where you share the cost of treatment with the insurer. Be sure to choose a policy with adequate coverage limits and reasonable deductibles that align with your budget and risk tolerance. Additionally, consider policies that offer 24/7 medical assistance and multilingual support, as this can be invaluable in navigating unfamiliar healthcare systems.

Tips of Southern Travel Insurance Review Coverage

One of the most important tips for Southern Travel Insurance Review Coverage is to read the fine print. Travel insurance policies can be complex documents, and it's crucial to understand the terms and conditions before you purchase a policy. Pay close attention to the exclusions, limitations, and pre-existing condition clauses. Make sure the policy covers the activities you plan to participate in and the destinations you intend to visit. Don't hesitate to ask the insurer questions if you're unsure about anything. Understanding the policy's details is essential for ensuring you have adequate coverage and avoiding surprises if you need to file a claim.

Another helpful tip is to compare quotes from multiple providers. Travel insurance prices can vary significantly, so it's worth shopping around to find the best deal. Use online comparison tools to quickly compare quotes and features from different insurers. Look for policies that offer comprehensive coverage at a reasonable price. Consider factors such as the policy's medical coverage, trip interruption and cancellation benefits, and lost or stolen belongings protection. Read customer reviews to get a sense of the insurer's reputation and claims processing efficiency. By comparing quotes and considering these factors, you can find a travel insurance policy that meets your needs and budget.

Considerations for Adventure Activities

If your Southern Hemisphere adventure involves activities like hiking, climbing, diving, or any other potentially risky pursuit, it's crucial to ensure your travel insurance policy specifically covers these activities. Standard travel insurance policies often exclude coverage for certain extreme sports or adventure activities. You may need to purchase an add-on or upgrade your policy to ensure you're protected in case of injury or illness during these activities. Carefully review the policy's terms and conditions to understand what activities are covered and what exclusions apply. For example, some policies may cover hiking up to a certain altitude, while others may exclude coverage for activities that require specialized equipment or training.

When considering coverage for adventure activities, it's also important to assess the policy's medical evacuation coverage. In remote or mountainous areas, medical evacuation can be expensive and logistically challenging. Make sure your policy covers emergency medical evacuation to the nearest appropriate medical facility, including helicopter or air ambulance services if necessary. Additionally, consider purchasing a policy that offers search and rescue coverage, which can help cover the costs of locating and rescuing you if you get lost or injured in a remote area. By carefully considering these factors and choosing a policy that specifically covers your planned adventure activities, you can protect yourself from significant financial burdens and ensure a safer travel experience.

Fun Facts of Southern Travel Insurance Review Coverage

Did you know that some travel insurance policies offer coverage for pet care expenses if you're unable to return home due to a covered event? This can be a lifesaver if you're traveling with your furry friend and experience an unexpected delay or medical emergency. Another fun fact is that some policies offer coverage for the cost of replacing lost or stolen travel documents, such as passports or visas. This can be particularly helpful in countries where obtaining replacement documents can be a time-consuming and expensive process.

Furthermore, certain travel insurance policies offer coverage for the cost of changing your travel plans if you miss a connecting flight due to a covered event, such as a flight delay or cancellation. This can help you avoid costly rebooking fees and ensure you reach your final destination without unnecessary stress. Additionally, some policies offer coverage for the cost of hiring a translator if you need medical assistance in a foreign country and don't speak the local language. These fun facts highlight the diverse range of benefits that travel insurance policies can offer, beyond just basic medical coverage and lost luggage protection. By exploring these options and choosing a policy that aligns with your specific needs and travel plans, you can enhance your peace of mind and enjoy a more worry-free Southern Hemisphere adventure.

How to Secure Southern Travel Insurance Review Coverage

Securing Southern Travel Insurance Review Coverage involves several key steps. First, determine your travel needs by assessing your destination, planned activities, and personal health conditions. This will help you identify the specific coverage you require. Next, research different travel insurance providers and compare their policies. Use online comparison tools to quickly compare quotes and features from multiple insurers. Read customer reviews to get a sense of their reputation and claims processing efficiency. Pay close attention to the policy's exclusions, limitations, and pre-existing condition clauses.

Once you've identified a few promising policies, carefully review their terms and conditions. Don't hesitate to contact the insurer directly to ask questions and clarify any doubts you may have. Make sure the policy covers the activities you plan to participate in and the destinations you intend to visit. If you have any pre-existing medical conditions, be sure to disclose them to the insurer and ensure they are covered under the policy. Finally, when you're ready to purchase a policy, make sure you understand the payment terms and cancellation policy. Keep a copy of your policy documents and contact information readily accessible during your trip. By following these steps, you can secure Southern Travel Insurance Review Coverage that meets your needs and provides peace of mind during your Southern Hemisphere adventure.

What if Southern Travel Insurance Review Coverage

What if you experience a medical emergency in a remote part of the Southern Hemisphere without adequate travel insurance coverage? The consequences can be severe. Medical expenses in foreign countries can be incredibly high, and you may be required to pay upfront for treatment. Without insurance, you could face significant financial debt and difficulty accessing the necessary medical care. In some cases, you may even be denied treatment if you can't provide proof of insurance or payment.

Furthermore, if you require medical evacuation, the costs can be astronomical. Emergency medical evacuation from a remote area can easily cost tens of thousands of dollars. Without travel insurance, you would be responsible for covering these expenses out-of-pocket. In addition to medical emergencies, what if your trip is interrupted or cancelled due to unforeseen circumstances? Without travel insurance, you could lose non-refundable travel expenses, such as flights, accommodations, and tours. This can add up to a significant financial loss. By understanding the potential consequences of traveling without adequate travel insurance coverage, you can make an informed decision and protect yourself from financial hardship.

Listicle of Southern Travel Insurance Review Coverage

Here's a listicle of essential considerations for Southern Travel Insurance Review Coverage:

- Assess Your Needs: Determine your destination, activities, and health conditions.

- Compare Policies: Research and compare multiple travel insurance providers.

- Read the Fine Print: Understand the policy's terms, conditions, and exclusions.

- Check Medical Coverage: Ensure adequate coverage for medical expenses and evacuation.

- Consider Trip Interruption: Look for coverage for trip cancellation and interruption.

- Protect Your Belongings: Ensure coverage for lost or stolen luggage and personal items.

- Disclose Pre-Existing Conditions: Inform the insurer about any pre-existing medical conditions.

- Review Activity Coverage: Make sure the policy covers your planned activities.

- Understand the Claims Process: Know how to file a claim and what documentation is required.

- Keep Documents Accessible: Keep your policy documents and contact information readily available.

This listicle provides a concise overview of the key steps involved in securing Southern Travel Insurance Review Coverage. By following these guidelines, you can make an informed decision and choose a policy that provides the best protection for your Southern Hemisphere adventure. Remember to prioritize your needs and choose a policy that aligns with your budget and risk tolerance.

Question and Answer about Southern Travel Insurance Review Coverage

Here are some common questions and answers about Southern Travel Insurance Review Coverage:

Q: What is the most important aspect of travel insurance for the Southern Hemisphere?

A: Comprehensive medical coverage is crucial due to the potential for medical emergencies in remote areas and the high cost of healthcare in foreign countries.

Q: Does travel insurance cover pre-existing medical conditions?

A: Some policies may cover pre-existing conditions, but it's essential to disclose them to the insurer and ensure they are covered under the policy.

Q: What should I do if I need medical assistance while traveling?

A: Contact your travel insurance provider's emergency assistance hotline for guidance and support. They can help you locate medical facilities and coordinate medical evacuation if necessary.

Q: How do I file a claim with my travel insurance provider?

A: Contact your travel insurance provider as soon as possible and follow their instructions for filing a claim. Be prepared to provide documentation such as medical records, receipts, and police reports.

Conclusion of Southern Travel Insurance Review Coverage

Securing appropriate travel insurance for your Southern Hemisphere journey is not just a formality, it's an investment in your peace of mind and well-being. By understanding the unique risks associated with traveling in this region, carefully evaluating your needs, and comparing different policies, you can choose a travel insurance plan that provides comprehensive coverage and protects you from unforeseen financial burdens. Remember to read the fine print, disclose any pre-existing medical conditions, and keep your policy documents readily accessible. With the right travel insurance in place, you can embark on your Southern Hemisphere adventure with confidence, knowing that you're prepared for whatever may come your way.

Post a Comment for "Southern Travel Insurance Review Coverage in the Southern Hemisphere"